India’s individual income-tax framework has undergone notable changes since the Union Budget of 2025. The government revised the new tax-regime slabs and extended relief mechanisms, including a higher standard deduction for salaried taxpayers and pensioners. These measures shifted the baseline of tax liability for many individuals. As the Union Budget 2026 approaches, discussion has centred on whether the standard deduction will be increased further. This article sets out what is already law, what has been officially notified, and what the reform means in practical terms for taxpayers, while distinguishing confirmed measures from expectations reported in the press.

Background: What changed in Budget 2025 and the official position today

The across-the-board revision of individual tax slabs that took effect from the financial year 2025–26 (assessment year 2026–27) is the starting point for understanding the tax landscape currently in place. The Ministry of Finance announced a reworked set of rates under the new tax regime that reduced rates across income bands and included a statutory increase in the standard deduction available to salaried taxpayers and pensioners. The press release issued by the government on Budget day summarised the new rate structure and explicitly noted a standard deduction of ₹75,000 for salaried taxpayers, bringing the effective tax-free threshold to ₹12.75 lakh for salary earners when combined with the revised rebate arrangements.

The Income Tax Department’s guidance pages and the official notifications that followed Budget 2025 set out the operational details taxpayers use when preparing returns for AY 2026-27. These pages include the revised slab tables relevant to different categories of taxpayers (residents under 60, senior citizens and super-senior citizens) and the administrative notes on rebate provisions. The department’s public materials are the authoritative reference for which slab applies to whom and for ancillary rules such as the conditions for claiming rebates under section 87A.

Developments since the last Budget: statutory notifications and FAQs

Following Budget 2025, the Central Board of Direct Taxes and the Income Tax Department issued notifications and FAQs aimed at clarifying the operation of the new regime and its interaction with existing tax rules. These documents explain how the standard deduction is applied, how the section 87A rebate interacts with other components of taxable income, and how special-rate incomes (for example, certain capital gains taxed at specific rates) are treated for rebate purposes. The Income Tax Department’s FAQ document accompanying the Budget explicitly addresses common points of confusion and provides administrative guidance for taxpayers and tax practitioners.

At the time of writing, there has been no new statutory notification increasing the standard deduction beyond the ₹75,000 figure announced in the 2025 Budget. Notifications and formal changes to the Income-tax Act or rules are published on the Income Tax Department and Ministry of Finance portals; those sources remain the definitive record for any legally binding changes.

What the revised slabs and the standard deduction mean in practice

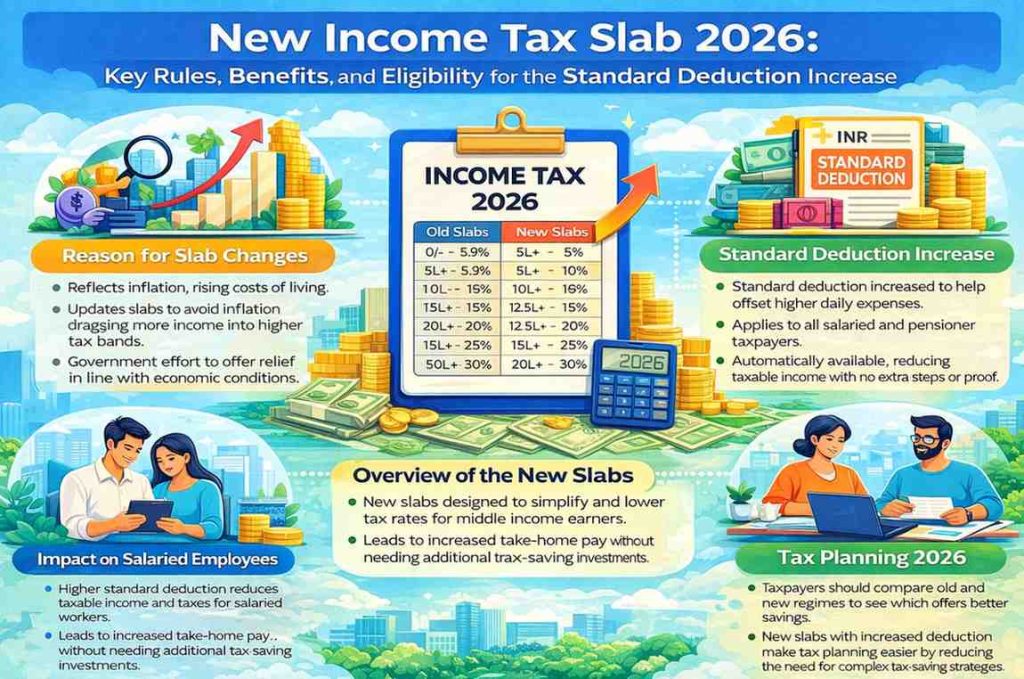

Under the new tax regime announced in Budget 2025, the tax rates for individual taxpayers were simplified and, for many middle-income earners, lowered. The central public summary released by the Finance Ministry laid out the new bands: nil tax up to ₹4 lakh, 5% for ₹4–8 lakh, 10% for ₹8–12 lakh, 15% for ₹12–16 lakh, 20% for ₹16–20 lakh, 25% for ₹20–24 lakh, and 30% for incomes above ₹24 lakh. Because the government also allowed a standard deduction of ₹75,000 for salaried taxpayers and pensioners, employers’ salary earners could enjoy an effective no-tax threshold of up to ₹12.75 lakh when rebate provisions were combined as designed. Those basic numerical foundations were set out in the official Budget statement and accompanying material.

The standard deduction operates as a flat deduction from salary income (or pension) that a taxpayer may claim in computing taxable income. Unlike many other deductions under the Income-tax Act, it does not ordinarily require proof of expense or investment to claim; it is a statutory allowance intended to approximate routine employment-related expenditures (such as commuting or work-related incidental costs) for salaried taxpayers. The increased standard deduction introduced in the 2025 Budget is applied automatically in the calculation of taxable salary income, subject to the tax regime the taxpayer chooses to follow. The precise interaction between the new regime’s simplifications and residual deductions is spelled out in the Income Tax Department’s guidance for return filing.

Eligibility: who can claim the standard deduction, and under which regimes

The standard deduction, as implemented in the rules following Budget 2025, applies to salaried individuals and pensioners. The statutory provision that governs deductions from salary income (section 16 of the Income-tax Act and related guidance) remains the operative vehicle through which the standard deduction is granted, even where the taxpayer opts for the new tax regime under section 115BAC or continues in the old regime where applicable. Official guidance published by the Income Tax Department explains which return form is applicable to salaried taxpayers and clarifies that the standard deduction is a component of the salary head computation before gross total income is aggregated.

It is important to distinguish between the “new” tax regime (which offers lower rates but fewer exemptions) and the “old” regime (which retains broader sets of deductions and exemptions). The Budget 2025 measures inserted a higher standard deduction available within the new structure so that salaried taxpayers could obtain automatic relief even in a regime with reduced scope for individual deductions. Taxpayers who are unsure which regime suits them must perform a comparison in the year of filing, because the choice of tax regime can materially alter the overall liability. The Income Tax Department’s return guidance pages provide the practical steps for making that comparison and for choosing the taxing regime when filing returns.

Impact analysis: how the 2025 changes affect taxpayers now, and what a further standard-deduction increase would mean

The Budget 2025 revisions were structured to provide immediate relief to middle-income taxpayers by lowering marginal rates and by using the standard deduction to lift the effective no-tax threshold for many salaried households. For a large number of salaried taxpayers, the combined effect of the new slab structure, the section 87A rebate as calibrated in Budget 2025, and the ₹75,000 standard deduction reduced or eliminated tax liability at income levels that previously attracted positive tax. Official commentary accompanying the Budget set out illustrative examples of tax benefit across income ranges. Those examples and the structure of the law are the reference for quantifying the direct impact on an individual’s take-home pay.

Observers and tax practitioners have also highlighted the distributional effect: lower and middle-income salaried households derive the most direct cash-flow benefit from a standard deduction hike because the allowance is unconditional and applies automatically. Pensioners similarly gain from the deduction because it reduces taxable pension income without additional compliance. For higher-income taxpayers, the deduction delivers a smaller proportional benefit.

Ahead of Budget 2026, financial press and tax advisory platforms have reported expectations and calls from some quarters for an increase in the standard deduction — suggestions range across media commentary from a modest rise to proposals for a substantially higher allowance. These are expectations and stakeholder suggestions reported by outlets in the public domain; they are not legislative changes. When assessing impact, the legally binding position remains the deduction set by Parliament and enacted into law or notified by the Central Board of Direct Taxes. Media expectations may be an indicator of policy debate but they cannot be treated as changes until formal notification.

Administrative and compliance implications for taxpayers and employers

From an administrative standpoint, the employers’ payroll and tax-deduction mechanisms will reflect the standard deduction and the new slab structure through the tax deduction at source (TDS) tables and software updates that are released by payroll vendors and the tax department’s guidance. Employers are required to follow statutory guidance and circulars issued by the Income Tax Department and the Central Board of Direct Taxes in implementing payroll changes; these instruments provide the operational detail — for example, how salaried employees’ tax withholding should be calculated when the standard deduction is applied. Taxpayers should expect employers to publish updated Form 16 and payroll statements reflecting the revised computation where relevant. The Income Tax Department’s return guidance pages and the FAQs issued after Budget 2025 set out the return forms and applicability for salaried taxpayers.

For taxpayers who are self-employed or who have non-salary income, the standard deduction does not apply in the same way; they should continue to rely on the array of deductions available under the Income-tax Act as relevant. The choice between the new and old regimes will therefore be consequential for non-salaried taxpayers because the benefit profile differs by income composition and investment profile.

Fiscal and policy considerations: why the government may or may not raise the standard deduction

Policymakers weighing a further increase in the standard deduction face trade-offs. On one hand, raising the deduction is politically and economically attractive because it directly increases disposable income for salaried households without requiring changes to complex tax benefit rules. On the other hand, larger increases in a universal, unconditional deduction have fiscal cost implications for government revenues. The Budget 2025 changes were framed by the Finance Ministry as both a simplification and a redistributive measure favouring middle-income taxpayers; any subsequent increase would require balancing revenue needs, fiscal deficit targets, and the Government’s broader expenditure priorities. Government statements and budget documents identify these trade-offs as part of the annual fiscal calculus.

Media coverage ahead of Budget 2026 has reflected those competing considerations: some financial commentators and tax-policy experts counsel targeted relief that does not erode revenue too rapidly, while business and consumer groups sometimes favour larger universal relief. Those debates are visible in press reporting and commentary, but the outcome depends on policy choices the Finance Ministry will present in the Budget and Parliament. Reporting of proposals in the run-up to Budget day is useful background; however, only the Budget speech and the subsequent Finance Bill and notifications constitute definitive action.

Practical guidance for taxpayers

Taxpayers and payroll administrators preparing for the filing season should follow these practical steps, based on official guidance:

- Confirm which tax regime you will choose for filing returns. The comparative net tax position depends on the composition of income, eligible deductions under the old regime, and the automatic nature of the standard deduction under the new regime. The Income Tax Department’s return pages explain the forms and conditions for salaried taxpayers and link to calculators and guidance for comparing regimes.

- Check payroll communications from your employer. Employers will typically update TDS computation and Form 16 to incorporate changes in statutory deductions and rates; ensure the values in your salary slip match the statutory basis.

- For pensioners, verify the treatment of pension income. The standard deduction applies to pension income in the same manner as salary, but other rules relating to pensions (such as specific allowances or exemptions) should be reviewed against official guidance.

- Keep an eye on formal notifications. Any change in standard deduction or slab rates will be notified by the Ministry of Finance or reflected in amendments to the Income-tax Act or rules and published on official portals. Media reports about expectations are not substitutes for the statutory instruments that govern tax liability.

- Consult a tax professional for complex situations. Where taxpayers have blended income — salary, capital gains at special rates, business income, or foreign income — the interaction of rebates and special-rate incomes can be intricate. Official guidance clarifies that certain special-rate incomes are excluded from some rebate calculations; practitioners can help interpret those rules for individual cases.

What the official record says today (summary of key facts)

• The revised slab structure and the standard deduction of ₹75,000 for salaried taxpayers and pensioners were announced in Budget 2025 and are reflected in the Income Tax Department’s public guidance and Budget FAQs. The government’s official Budget release outlines the new bands and the rationale given for those changes.

• Official Income Tax Department pages list the applicable slabs for different categories of taxpayers and provide administrative detail on return applicability and rebate provisions. These are the operative references for taxpayers completing returns for AY 2026-27.

• There has been reporting in the financial press that some stakeholders expect further increases in the standard deduction in Budget 2026; these items reflect commentary and expectations but do not constitute legal change until the government furnishes a Budget speech, Finance Bill provisions, or formal notifications. Taxpayers should treat them as commentary until formally enacted.

The road ahead: Budget 2026 and the formal process for change

Any modification to the standard deduction or to the slabs must be proposed in the Finance Bill and enacted by Parliament, after which implementing notifications and circulars are issued by the Central Board of Direct Taxes and the Income Tax Department. The Union Budget presentation and the Finance Bill mark the formal starting point for such legal change. Until then, the existing statutory position — as set by the Budget 2025 measures and implemented through notifications and departmental guidance — remains binding. For taxpayers tracking possible change, the official portals of the Ministry of Finance, Central Board of Direct Taxes and the Income Tax Department are the authoritative sources to monitor.

Conclusion

The tax-code adjustments crystallised in Budget 2025 — a revised new-regime slab schedule and a higher standard deduction of ₹75,000 for salaried employees and pensioners — materially altered the tax landscape for many taxpayers. Those changes are implemented through statutory instruments and administrative guidance that continue to govern filings for the current assessment year. Ahead of Budget 2026, the debate over further enhancement of the standard deduction is active in media and advisory circles, but any definitive change will require the formal Budget process and parliamentary enactment. Taxpayers should rely on the Income Tax Department and Ministry of Finance publications for legally binding information, and consult tax professionals for individualised planning in light of the confirmed rules.

Add newsestate.in as preferred source on google – click here

Last Updated on: Thursday, January 29, 2026 10:18 am by News Estate Team | Published by: News Estate Team on Thursday, January 29, 2026 10:18 am | News Categories: India