India’s income tax framework in 2026 is undergoing a quiet but significant shift. While there may not be dramatic headline-grabbing tax rate changes every year, the government’s focus has steadily moved towards compliance, transparency, and real-time reporting. For salaried employees and small taxpayers, this means that filing income tax returns is no longer just an annual formality but part of a more integrated financial reporting ecosystem.

The revised income tax compliance rules introduced for 2026 aim to simplify processes on paper while tightening scrutiny behind the scenes. This dual approach is designed to reduce tax evasion, widen the tax base, and encourage voluntary compliance. However, it also changes how individuals must maintain records, disclose income, and respond to tax notices.

A Shift From Annual Filing to Continuous Financial Tracking

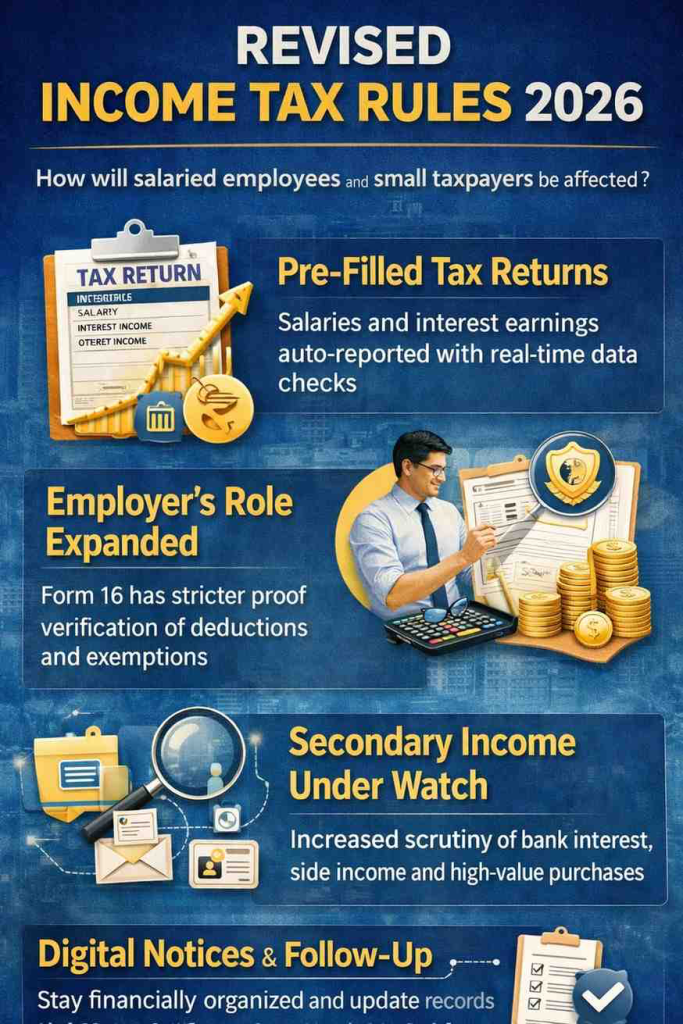

One of the most notable changes in 2026 is the growing reliance on pre-filled and system-generated data. Salaried employees are now seeing their income tax returns populated with details sourced from employers, banks, mutual funds, insurance companies, and digital payment platforms. Salary income, interest earnings, dividend income, and even high-value transactions are increasingly auto-reported to the tax department.

This reduces manual data entry and the risk of clerical errors, but it also leaves little room for omissions. Any mismatch between personal disclosures and system-captured data is likely to trigger alerts. For employees who previously depended on last-minute document collection, the emphasis has shifted to year-round financial discipline.

Revised Role of Employers in Salary Tax Compliance

Employers in 2026 carry greater responsibility in ensuring accurate tax compliance for their workforce. Salary structures, exemptions, and deductions claimed by employees are now subject to stricter verification before being reflected in Form 16. Companies are expected to validate proof submissions more rigorously, especially for house rent allowance, leave travel benefits, and tax-saving investments.

For salaried employees, this means fewer opportunities to adjust declarations at the time of filing returns. What gets reported by the employer during the financial year increasingly becomes final, reinforcing the need for early and accurate tax planning.

Impact on Deductions and Exemptions Claimed by Individuals

The revised compliance framework places sharper focus on deduction claims under popular sections related to investments, insurance premiums, housing loans, and health expenses. While deductions remain available, the tax department’s systems are now better equipped to cross-verify claims with third-party data.

Small taxpayers, in particular, are being encouraged to choose between simplified tax regimes and traditional deduction-based regimes with full awareness of compliance obligations. Over-reporting deductions or failing to maintain supporting documents can lead to follow-up notices, even if the tax amount involved is relatively small.

Increased Scrutiny of Secondary and Passive Income

Salaried individuals increasingly earn income beyond their monthly paycheques, including bank interest, freelance work, online consulting, or digital content creation. In 2026, such supplementary income streams are under closer observation due to improved data sharing between platforms and tax authorities.

Interest earned from savings accounts, fixed deposits, and recurring deposits is now more transparently reported. For small taxpayers who previously ignored minor income sources assuming they would go unnoticed, the revised rules signal that comprehensive disclosure is no longer optional.

Simplification for Small Taxpayers With Built-In Checks

While compliance has become stricter, the government has also introduced measures aimed at simplifying the experience for small taxpayers. Pre-validated returns, guided filing systems, and faster processing timelines have reduced the technical complexity of filing returns.

At the same time, built-in checks ensure that incorrect claims are flagged instantly. Refunds are processed faster when returns match system data, while discrepancies may delay processing until clarifications are provided. This creates a clear incentive structure that rewards accuracy and transparency.

Expanded Use of Digital Notices and Faceless Communication

The tax department’s move towards faceless and digital communication continues to expand in 2026. Notices related to mismatches, additional disclosures, or verification requests are now primarily issued through online portals and registered email addresses.

For salaried employees and small taxpayers, this means staying alert to official communication throughout the year, not just during the filing season. Missing a notice or failing to respond within prescribed timelines can lead to penalties, even if the underlying issue is minor.

What These Changes Mean for Compliance Culture

The revised income tax compliance rules reflect a broader shift in India’s tax administration philosophy. The emphasis is less on punitive action after evasion and more on preventing errors through real-time data integration. For honest taxpayers, this promises fewer disputes and quicker resolutions, provided disclosures are accurate.

For those accustomed to informal or incomplete reporting, the new system serves as a clear signal that compliance expectations have risen. Salaried employees and small taxpayers are now active participants in a digitally monitored ecosystem where transparency is built into everyday financial transactions.

Looking Ahead to a More Predictable Tax Environment

As India’s tax system matures, the changes introduced in 2026 are likely to shape taxpayer behavior in the long term. Better alignment between reported income and actual financial activity could lead to more predictable tax outcomes and reduced litigation.

For salaried employees and small taxpayers, the message is clear: income tax compliance is no longer a once-a-year exercise but an ongoing responsibility. Those who adapt early by maintaining accurate records, understanding their salary structures, and monitoring secondary income will find the transition smoother in the years ahead.

Add newsestate.in as a preferred source on google – click here

Last Updated on: Thursday, January 29, 2026 7:55 pm by News Estate Team | Published by: News Estate Team on Thursday, January 29, 2026 7:55 pm | News Categories: News