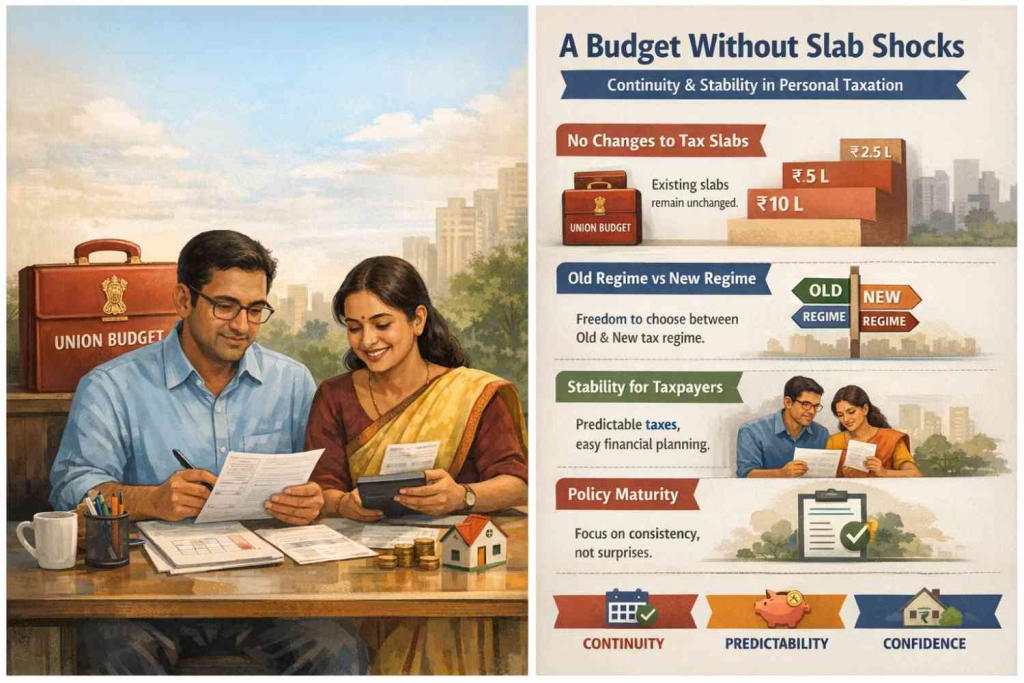

In the Union Budget for FY 2026–27, Finance Minister Nirmala Sitharaman offered salaried employees and pensioners a blend of continuity and cautious reform. While most headline income tax slabs and rates remained unchanged, the broader context of tax relief and procedural adjustments reflects the government’s effort to balance fiscal prudence with middle-class relief.

Unlike previous years, there were no sweeping changes to the tax rate structure itself for individuals — either under the new tax regime or the old tax regime. This means that the familiar progression of tax brackets that many taxpayers have grown accustomed to will continue into the fiscal year beginning April 1, 2026.

For salaried employees and pensioners, this continuity offers predictability — an essential element when families are already planning budgets around rising living costs and inflation.

Understanding the New vs Old Tax Regimes

At the heart of the personal income tax framework in India are two parallel systems: the new tax regime and the old tax regime. Taxpayers can choose between them when they file their returns, depending on which yields better benefit after accounting for deductions and exemptions.

Under the new tax regime, the system rewards simplicity with lower tax rates and fewer deductions. In contrast, the old regime maintains a wide array of exemptions and deductions — like House Rent Allowance (HRA), Leave Travel Allowance (LTA), and certain investment-linked deductions — which can be beneficial for those with higher deductible expenses.

For FY 2026–27, both regimes remain available with no alteration to the slabs themselves. That means the familiar structure — where income up to ₹4 lakh is tax-free and higher slabs attract rising percentage rates up to 30 % — continues. .

Standard Deductions: What Remains and What Doesn’t

One of the most widely used provisions by salaried individuals is the standard deduction — a fixed amount that reduces taxable income without needing bills or proofs.

Contrary to some expectations ahead of the Budget, there was no increase in the standard deduction for FY 2026–27. It remains at ₹75,000 under the new tax regime and ₹50,000 under the old regime for both salaried employees and pensioners.

Because this deduction applies automatically to salary or pension income, it subtly enhances take-home pay by lowering taxable income. Even with a ₹75,000 deduction, a middle-income employee with a gross salary of up to approximately ₹12.75 lakh may effectively pay no income tax when eligible for the Section 87A rebate under the new regime.

Section 87A Rebate: Tax-Free Threshold for the Middle Class

Under the new tax regime, Section 87A rebate continues to be a pivotal feature for taxpayers earning on the lower to middle end of the income scale. This rebate can reduce tax liability to zero for individuals whose taxable income (after deductions) does not exceed a certain limit.

For FY 2026–27, the rebate threshold remains unchanged, disappointing some taxpayers and advisors who had hoped for adjustment in line with inflation. This means taxpayers must carefully plan their deductions — especially standard and other eligible deductions — to maximise this benefit.

Procedural Changes Affecting Salaried Taxpayers

While the Budget didn’t overhaul slab rates, it introduced important procedural changes that affect how taxpayers comply with the law.

Perhaps most significant for many is the revision in the deadline for filing revised Income Tax Returns (ITR). Taxpayers now have until March 31 of the assessment year to revise their return, extending from the earlier December 31 deadline. However, this extension comes with a nominal penalty if revision happens after December 31 — ₹5,000 in most cases, reduced to ₹1,000 for individuals with taxable income up to ₹5 lakh.

The aim of this change is to give taxpayers and chartered accountants more breathing space to correct inadvertent mistakes or omissions — a common challenge in complex tax filings.

Beyond Salaries: Broader Tax Policy Shifts in 2026

Though the headline concern for most salaried taxpayers is “how much tax will I pay?”, the Budget also signalled broader shifts that have secondary impact.

For instance, the government announced changes in taxation for Sovereign Gold Bonds (SGBs), share buybacks, and securities transaction tax (STT) on derivatives — areas that indirectly shape investor behaviour for those with additional income streams.

Policy refinements such as PAN-based TDS on property sales by non-resident Indians (NRIs) and automated NIL deduction certificates are aimed at improving compliance while reducing procedural friction for taxpayers.

Senior Citizens and Pensioners: A Special Lens

Senior citizens and pensioners often face unique considerations when it comes to income tax — not just because of age but due to the nature of their income mix.

For many in this group, pension counts as part of taxable income just like salary. Both salaried pensioners and employees benefit from the standard deduction, which applies equally to both categories.

Though no additional senior-specific relief was introduced in this Budget, the existing framework — where older taxpayers can choose between regimes and claim available deductions — remains intact.

What Taxpayers Should Do Now

As the financial year unfolds, salaried individuals and pensioners should take a proactive stance in tax planning. This includes understanding which tax regime suits their overall income structure, making informed use of deductions like the standard deduction, and keeping abreast of filing deadlines to avoid penalties.

Taxpayers may also benefit from consulting chartered accountants or tax professionals to optimise their returns — especially in a year where slabs have stayed static but compliance rules have shifted subtly.

Looking Ahead: Stability With Gradual Reform

The income tax landscape for FY 2026–27 underscores a trend towards stability rather than disruption. While there were no dramatic changes to slabs or deductions, procedural reforms and the retention of key benefits like the Section 87A rebate and standard deduction reflect a calibrated approach by policymakers.

Add newsestate.in as a preferred source on google – click here

Last Updated on: Monday, February 2, 2026 3:25 pm by News Estate Team | Published by: News Estate Team on Monday, February 2, 2026 3:25 pm | News Categories: News