Juspay’s 2026 Unicorn Entry: What Founders Can Learn from the Infrastructure-First Fintech Model

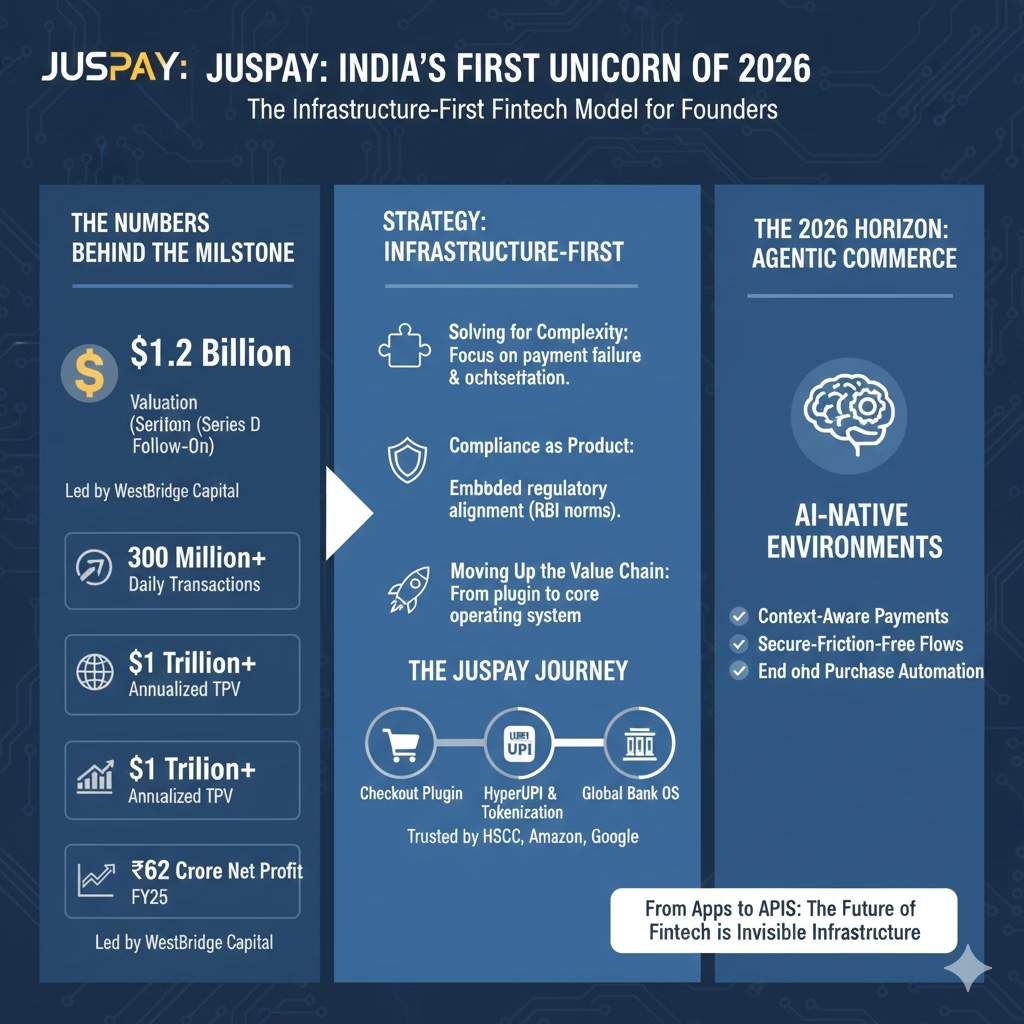

BENGALURU – In a year where venture capital remains surgically selective, Bengaluru-based Juspay has etched its name as India’s first unicorn of 2026. Closing a $50 million Series D follow-on round led by WestBridge Capital, the company’s valuation has climbed to $1.2 billion.

While the “unicorn” tag is a familiar milestone in the Indian startup lexicon, Juspay’s ascent is distinct. Unlike the consumer-facing fintech giants that dominated the last decade through aggressive user acquisition and “cashback” wars, Juspay has reached the billion-dollar mark by becoming the invisible, indispensable “plumbing” of the global digital economy.

The Numbers Behind the Milestone

The funding, which saw participation from existing heavyweights like SoftBank, Accel, and Kedaara Capital, is a mix of primary and secondary transactions. For founders, the secondary component—offering liquidity to early employees and investors for the second time in a year—signals a healthy, sustainable growth trajectory.

Juspay’s scale is staggering:

Transaction Volume: Processes over 300 million daily transactions.

Annualized TPV: Exceeds $1 trillion.

Profitability: Reported a net profit of ₹62 crore in FY25, a rare feat in the high-burn fintech sector.

The “Infrastructure-First” Strategy: A Masterclass for Founders

Juspay’s journey offers a blueprint for the next generation of B2B and SaaS founders. Here is how they turned “boring” backend code into a billion-dollar moat.

1. Solving for Complexity, Not Popularity

Most fintechs started by trying to win the customer’s wallet. Juspay started by trying to solve the payment failure. By focusing on “first-principles engineering,” they built a payment orchestration layer that intelligently routes transactions through the best available bank or gateway.

2. Compliance as a Product Feature

In 2024 and 2025, when the Reserve Bank of India (RBI) tightened norms for Payment Aggregators (PA), many players scrambled to adapt. Juspay, however, had already embedded regulatory alignment into its core architecture. Their “compliance-first” infrastructure turned a hurdle into a competitive advantage, allowing them to onboard enterprise giants like HSBC, Amazon, and Google who require bank-grade security.

3. Moving Up the Value Chain

Juspay’s evolution is a lesson in product expansion:

- Phase 1: A simple checkout plugin to reduce friction.

- Phase 2: A full-stack UPI and tokenization platform (HyperUPI).

- Phase 3: A core payments operating system for global banks.By moving from a “vendor” to a “foundational partner,” Juspay ensured that their revenue scales with the growth of the entire digital ecosystem, not just their own sales team.

The 2026 Horizon: Agentic AI and Global Rails

As Juspay enters its unicorn era, the focus is shifting toward Agentic Commerce. The company is currently investing heavily in AI-native environments where “agents” can handle end-to-end purchase flows—context-aware, secure, and friction-free.

“Our focus over the last decade has been on solving the core complexities of global payments,” said Sheetal Lalwani, Co-founder and COO, in a recent statement. “This round reflects our growth and provides liquidity opportunities for our team members who have been part of this journey.”

Conclusion: The Shift from Apps to APIs

Juspay’s $1.2 billion valuation marks a symbolic shift in the Indian startup ecosystem. If the 2010s were about the “App Economy,” 2026 is firmly the era of the “API Economy.” For entrepreneurs, the message is clear: the most stable and scalable bets are no longer on who gets paid, but on who keeps the payments running.

Add newsestate.in as a preferred source on google – click here

Last Updated on: Tuesday, January 27, 2026 9:50 am by News Estate Team | Published by: News Estate Team on Tuesday, January 27, 2026 9:50 am | News Categories: News