A nationwide bank strike today has disrupted routine banking operations across the country, affecting cash withdrawals, cheque clearances, branch services, and customer support. While digital banking channels remain largely operational, the strike poses immediate challenges for startup founders and micro, small and medium enterprises (MSMEs), particularly in managing day-to-day payments, payroll, and short-term liquidity. Understanding the impact and preparing alternative arrangements can help businesses minimise disruption and maintain continuity.

Why the Nationwide Bank Strike Matters for Businesses

Bank strikes directly affect physical banking services, which many businesses still rely on for cash handling, documentation, and certain transaction approvals. For startups and MSMEs operating with tight cash flows, even a short disruption can delay vendor payments, employee salaries, and collections from clients.

The timing of such strikes is especially critical for smaller businesses that may not have large cash buffers or diversified banking relationships. Unlike large corporations, MSMEs often depend on a limited number of bank accounts and credit lines, making them more vulnerable during service interruptions.

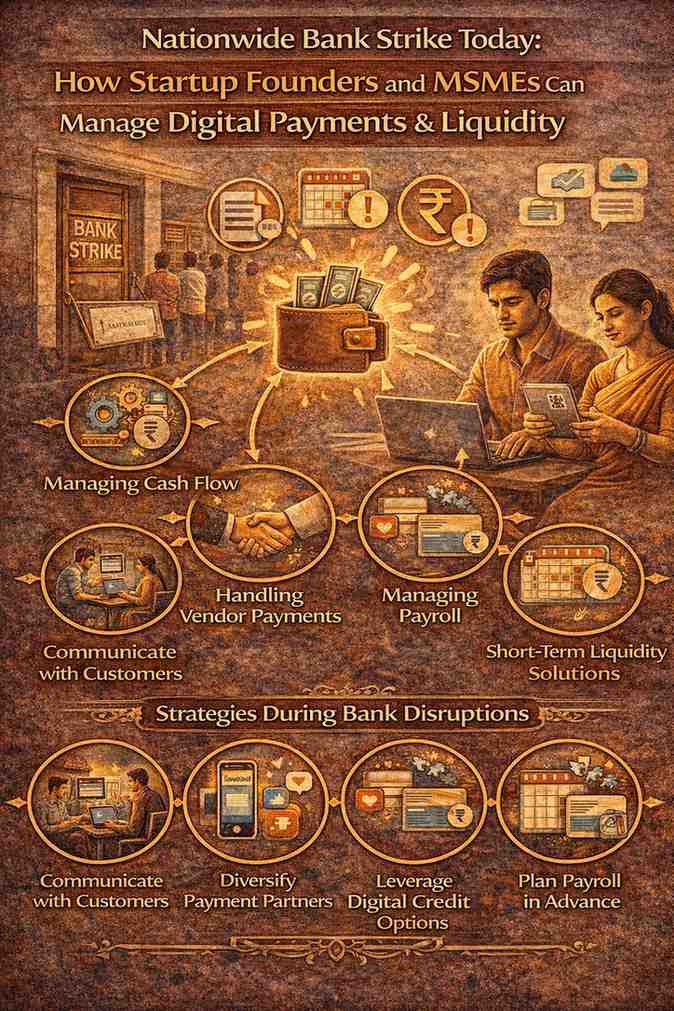

Impact on Cash Flow and Liquidity

Liquidity management becomes a key concern during a bank strike. Cash withdrawals may be restricted, branch-based deposits delayed, and loan-related services slowed. Businesses that rely on daily cash collections, such as retail stores or service providers, may face challenges in depositing funds or accessing working capital.

Delayed inflows and outflows can create short-term cash mismatches. Even if digital transactions continue, settlement delays or limited customer support can affect confidence and planning, particularly for businesses managing multiple payments in a single day.

Role of Digital Payments During a Bank Strike

Digital payment systems play a crucial role in cushioning the impact of a bank strike. Unified payment platforms, mobile banking apps, and online transfers typically continue to function, allowing businesses to receive and make payments without visiting branches.

Startup founders and MSMEs that have already integrated digital payments into their operations are better positioned to manage disruptions. Encouraging customers and vendors to use digital modes such as instant transfers, QR-based payments, and online invoicing can help maintain cash flow during the strike period.

Managing Vendor and Supplier Payments

One of the immediate concerns during a bank strike is meeting payment commitments to suppliers and service providers. Delays can strain relationships, especially for small businesses that depend on timely deliveries and services.

Clear communication is essential. Informing vendors about potential delays and confirming alternative digital payment options can help avoid misunderstandings. Where possible, prioritising critical payments and rescheduling non-urgent ones can ease pressure on limited liquidity.

Handling Payroll and Employee Payments

Employee salaries and contractor payments are sensitive issues during banking disruptions. Delays can affect morale and trust, particularly in startups and small enterprises where teams are lean and closely connected.

Using digital salary transfers and advance planning can help mitigate risks. Businesses that anticipate strike-related delays may choose to process payroll earlier or communicate transparently with employees about timelines. Maintaining clarity and trust is often as important as the payment itself.

Short-Term Liquidity Planning Strategies

During a bank strike, proactive liquidity planning becomes essential. Businesses can review available balances across accounts, assess incoming receivables, and identify essential expenses that must be covered immediately.

Access to digital credit lines, fintech-based working capital solutions, or overdraft facilities can provide temporary relief. While these options may involve costs, they can help bridge short-term gaps and prevent operational disruptions.

Leveraging Multiple Banking and Payment Partners

Diversification is a key lesson highlighted by recurring banking disruptions. Startups and MSMEs that maintain relationships with multiple banks or payment service providers are better equipped to handle strikes or outages affecting a single institution.

Using a mix of traditional banks, digital wallets, and payment gateways reduces dependence on any one channel. Over time, this approach strengthens resilience and improves operational flexibility.

Communicating With Customers During Disruptions

Customer communication is often overlooked during operational challenges. Informing customers about preferred payment modes during the strike can help ensure smooth transactions and avoid confusion.

Clear messaging through invoices, websites, and social media channels can guide customers toward digital payment options. Transparency reinforces trust and reduces the risk of delayed or missed payments.

Long-Term Lessons for Startups and MSMEs

While a nationwide bank strike is a short-term event, it highlights longer-term vulnerabilities in how businesses manage payments and liquidity. Dependence on physical banking processes and limited cash buffers can expose startups and MSMEs to repeated disruptions.

Investing in digital financial infrastructure, building emergency liquidity reserves, and planning for contingencies are essential steps for long-term stability. These measures not only help during strikes but also improve overall financial efficiency.

The Road Ahead

Nationwide bank strikes underscore the importance of preparedness and adaptability for India’s startup ecosystem and MSME sector. While digital payments offer a strong safety net, effective liquidity management and communication remain critical.

For founders and business owners, the focus today is on continuity rather than disruption. By leveraging digital tools, planning cash flows carefully, and maintaining transparent relationships with employees, vendors, and customers, startups and MSMEs can navigate the challenges of a bank strike with minimal impact and emerge more resilient for the future.

Also read – https://newsestate.in/best-hill-stations-in-north-india-for-snowfall/

Add newsestate.in as preferred source on google – click here

Last Updated on: Tuesday, January 27, 2026 9:49 am by News Estate Team | Published by: News Estate Team on Tuesday, January 27, 2026 9:49 am | News Categories: News