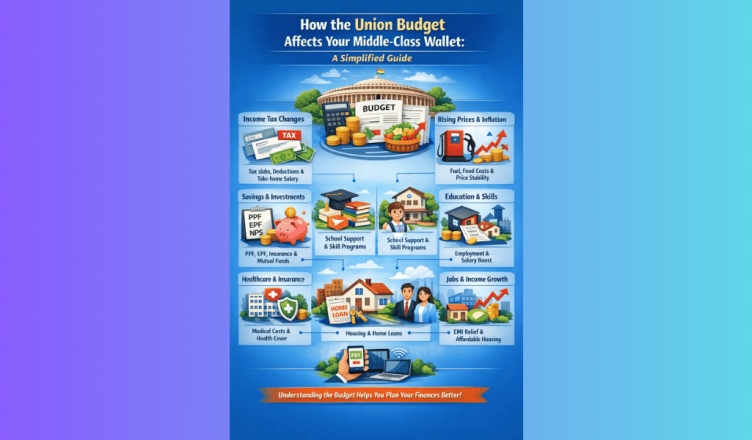

Every year, the Union Budget grabs headlines with big numbers and complex announcements. While policymakers discuss growth, deficit, and capital expenditure, the middle class looks for one simple answer: how will this budget affect my daily life and finances?

From income tax to household expenses, the Union Budget plays a crucial role in shaping the financial well-being of middle-class families. This article explains its impact in a simple and practical way.

Income Tax: The Most Direct Impact

Income tax decisions are the most closely watched part of the Union Budget for the middle class. Changes in tax slabs, standard deductions, or exemptions directly affect take-home salary.

When tax relief is provided, families enjoy higher disposable income, which can be used for savings, investments, or lifestyle expenses. On the other hand, fewer deductions or higher taxes can strain monthly budgets. The option between the old and new tax regimes also influences long-term financial planning.

Rising Prices and Inflation Control

The Union Budget influences inflation through fuel taxes, subsidies, and government spending. Fuel prices affect transportation costs, which in turn raise the prices of food and daily essentials.

When the government allocates funds to control inflation and support essential commodities, it helps the middle class manage household expenses more effectively. Stable prices mean better financial predictability and less pressure on monthly income.

Savings, Investments, and Financial Security

Middle-class families rely heavily on savings instruments like PPF, EPF, NPS, insurance, and mutual funds. Budget announcements related to interest rates and tax benefits on these instruments directly impact long-term wealth creation.

Encouraging savings through tax incentives helps families plan for retirement, children’s education, and future emergencies with confidence.

Education and Skill Development

Education is a priority—and a major expense—for most middle-class households. Budget allocations for schools, colleges, scholarships, and skill development programs help reduce the financial burden on families.

Support for education loans and digital learning initiatives also ensures better opportunities for students without significantly increasing costs for parents.

Healthcare and Medical Expenses

Healthcare expenses can disrupt even the most stable middle-class budget. Increased spending on public healthcare infrastructure, affordable medicines, and health insurance tax benefits provides financial relief.

Lower medical costs mean families can protect their savings and avoid debt during health emergencies.

Housing and Home Ownership

Owning a home is a long-term dream for many middle-class families. Budget policies related to affordable housing, home loan interest deductions, and real estate development play a key role.

Tax benefits on housing loans and government-backed housing schemes make home ownership more achievable and reduce the financial burden of EMIs.

Employment Opportunities and Income Growth

Government spending on infrastructure, manufacturing, startups, and MSMEs boosts job creation. More employment opportunities lead to income stability and career growth for the middle class.

A strong focus on economic development improves salary prospects and job security, helping families plan their finances with greater confidence.

Digital Services and Ease of Living

The Union Budget also focuses on improving digital infrastructure and public services. Investments in digital payments, online government services, and connectivity reduce paperwork and save time and money.

For working professionals and small business owners, this ease of access translates into better productivity and convenience.

Conclusion

The Union Budget is not just a financial statement—it is a roadmap that shapes the everyday lives of middle-class families. From taxes and savings to healthcare and housing, every decision has a direct or indirect impact on household finances.

By understanding how the Union Budget affects their wallet, middle-class citizens can make smarter financial choices, plan better for the future, and navigate economic changes with confidence.

Last Updated on: Saturday, January 24, 2026 4:11 pm by News Estate Team | Published by: News Estate Team on Saturday, January 24, 2026 4:11 pm | News Categories: India, Business, Opinion, Politics, Trending