When Finance Minister Nirmala Sitharaman presented the Union Budget 2026–27 on 1 February 2026, one of the most closely watched issues was whether personal income-tax rates or exemption thresholds would be altered. The Budget announces that the Income-tax Act, 2025 a consolidated, reworked statute to replace the Income-tax Act, 1961 will come into effect from April 2026, and it introduces a raft of procedural and substantive tax changes aimed at simplification, dispute reduction and targeted relief. However, the headline personal income-tax slab rates for individuals under both the new and the old regime were not revised in the 2026 Budget.

Background: why slabs mattered this year

Every Budget season, taxpayers scan the Finance Minister’s speech for adjustments to tax rates, thresholds and deductions that directly affect take-home pay. Since the introduction of the parallel “new” tax regime in 2020 (which offered lower rates but fewer exemptions and deductions), households have had to choose between the old (reliefs and deductions retained) and new (simplified slabs, fewer deductions) regimes. Ahead of Budget 2026, commentators and taxpayer groups urged higher exemption limits and simplified deduction rules, particularly for middle-income households facing rising costs. Several proposals floated in pre-Budget commentary included increasing the basic exemption or raising the slab thresholds under the new regime, and changing the scope or caps of popular deductions such as Section 80C and 80D.

What the Budget actually announced (developments)

1. New Income-tax Act, 2025 comes into force (April 2026)

The Budget documents and the Finance Minister’s speech confirm that the Income-tax Act, 2025 the government’s reworked code to replace the Income-tax Act, 1961 will take effect from April 2026. The speech and accompanying material describe the Act as part of a broader reform programme to simplify law and reduce litigation, and they set out legislative and administrative measures intended to make compliance easier.

Why this matters: a new consolidated statute changes the legal architecture under which rates, deductions and compliance rules operate. But enactment of a new Act does not automatically mean tax-rate changes; the 2026 Budget implements the Act alongside specified amendments and transitional arrangements.

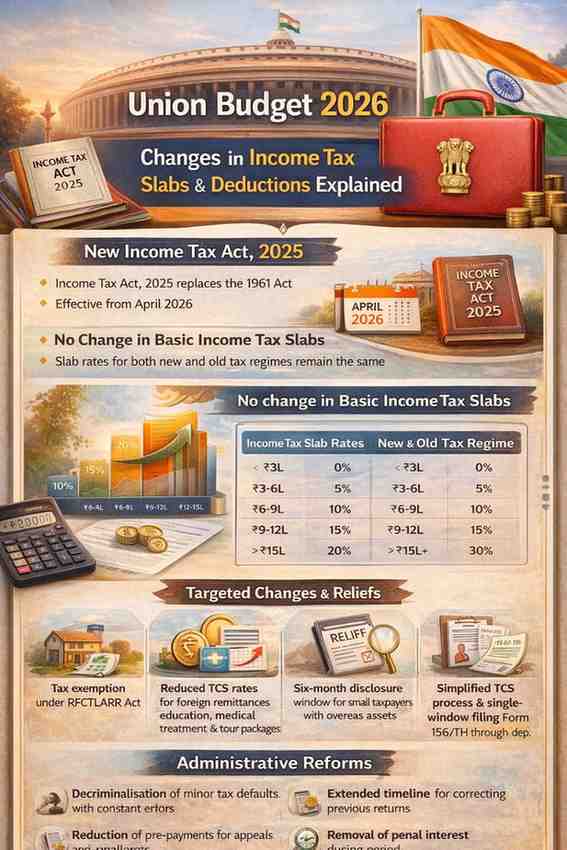

2. No change to core personal income-tax slab rates or thresholds

After the Budget speech it was clarified in reporting and the official Budget documents that the basic slab structure for individuals both under the old and the new tax regimes was retained for FY 2026–27. In other words, taxpayers will continue to be taxed under the same slab rates and thresholds they used for FY 2025–26, unless they opt to move between the regimes. Reporting by leading business outlets summarised the position that slabs and surcharge structures remain unchanged in the Budget.

What this means in practice: for most salaried taxpayers and individual taxpayers who expected an across-the-board rise in exemption limits, there is no automatic reduction in taxable income due to slab adjustments. Instead, the Budget focuses on procedural simplification, specific exemptions and targeted reliefs described below.

3. Targeted exemptions and deduction changes affecting individuals and households

While slab rates did not change, the Budget provides a set of narrower measures that may affect tax liabilities for particular taxpayers:

- Exemption for compensation under RFCTLARR Act (land acquisition): The Budget proposes that compensation received from compulsory land acquisition under the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement (RFCTLARR) Act will not be treated as taxable income. The change is aimed at ensuring that individuals receiving state compensation are not taxed on such receipts. (This measure was flagged in the Budget coverage and explanatory notes.)

- Allowances and deductions for cooperative structures in the new regime: The Budget’s tax-reform note proposes extending certain deductions to cooperative societies (for example, inter-cooperative dividend treatment) and limited, time-bound exemptions for notified national cooperative federations on dividend income. These are targeted at cooperative entities but can have downstream effects on members’ receipts and taxation in specific arrangements.

- TCS (Tax Collection at Source) reductions for foreign remittances related to education and medical purposes, and for overseas tour packages: The Budget reduces the TCS rate for Liberalised Remittance Scheme (LRS) remittances for education and medical purposes and for certain overseas tour packages. This eases the immediate cash-flow impact on families sending money abroad for tuition or medical treatment.

- Facility for single-window filing of declarations (Form 15G/15H) via depositories, and simplification of TDS/TCS procedures: The Budget proposes operational measures such as allowing a taxpayer to file a single declaration with a depository for no deduction of tax at source on certain securities income (mutual fund units, interest from securities, dividends) and simplified TDS/TCS rules and forms intended to reduce multiplicity and friction in withholding and collection. These are procedural changes that affect how tax is collected at source and reported, and may lower inadvertent TDS/TCS for some investors.

- One-time six-month foreign asset disclosure scheme for small taxpayers: The Budget proposes a short window for small taxpayers (students, young professionals, relocated NRIs and similar taxpayers) to disclose overseas income or assets below a certain threshold, designed to regularise minor non-compliance without heavy enforcement.

4. Administrative, compliance and penal reform measures with taxpayer impact

Beyond exemptions and TCS fine-tuning, the Budget introduces several administrative reforms that affect taxpayers’ interaction with the tax system:

- Decriminalisation and graded penalties: Procedural lapses are to be largely decriminalised and replaced with fines or graded punishments. The Budget seeks to limit imprisonment to cases of grave offences and proposes fees in place of penalties for routine compliance defaults, thus reducing the risk of criminal prosecution for technical breaches.

- Extended timelines and easier correction of returns: The Budget’s tax-reform note envisages extended timelines for revised and updated returns for MSMEs and other taxpayers, intended to let taxpayers correct errors with reduced fear of punitive action.

- Reduction in pre-payment for appeals and interest relief during appeal: The Budget proposes to reduce quantum of pre-payment for appeals and to remove interest liability on penalties during the period of appeal to the first appellate authority, reforms aimed at easing cash-flow pressure during litigation.

Impact: who gains, who does not, and the practical implications

Middle-income salaried households

Because slab rates and primary thresholds were retained, there is no automatic across-the-board tax cut for salaried households. For taxpayers who had hoped for a higher basic exemption or elevated slabs under the new regime, the Budget does not deliver that immediate relief. Those taxpayers continue to decide between the two regimes based on their own deduction profiles.

However, several administrative measures may help reduce friction and lower incidental tax costs:

- Reduced TCS on education and medical remittances improves short-term cash flow for families sending money abroad for those specific purposes.

- Simplified declaration and TDS/TCS processes may prevent multiple withholdings and reduce need for refunds and follow-up, particularly for investors receiving dividends, interest and mutual fund payouts.

Farmers and landowners whose land is acquired

The proposed tax exemption on compensation paid under RFCTLARR means that individuals whose land is compulsorily acquired by government agencies will not have to treat the compensation as taxable income. This is a targeted benefit for a specific set of taxpayers affected by acquisition.

Cooperatives and their members

Changes to allow certain cooperative-to-cooperative dividend treatments in the new regime aim to eliminate double taxation within cooperative networks and strengthen capital flows inside these entities. These measures are sectoral, but may indirectly affect incomes of cooperative members and participants.

Small taxpayers with overseas assets

The one-time disclosure window is designed to bring into compliance those with small foreign assets or income without immediate harsh enforcement. For eligible small taxpayers, voluntary disclosure during the window could avoid future penalties.

Investors and litigants

Reforms aimed at dispute reduction, extended timelines for correction, and lower pre-payment thresholds for appeals may reduce the litigation burden on businesses and larger taxpayers. These are less immediately material to the salaried middle class but are important for corporate and high-net-worth taxpayers who often face lengthy tax disputes.

What taxpayers should do now (practical checklist)

1. Re-evaluate regime choice only if your circumstances changed. With slabs unchanged, many taxpayers will find their prior calculation still valid; but any changes in income, investments, or eligible deductions (for example, shifting to or from exemptions newly clarified by the 2025 Act) should prompt a fresh comparison.

2. Use the TCS/TDS simplifications to avoid double withholdings. Where possible, file proper declarations (Form 15G/15H) through depository channels if you are eligible, and ensure your PAN is quoted correctly with payers to avoid unnecessary TDS. The Budget foreshadows a single-window approach for such declarations; implement it once CBDT and depositories publish operational guidance.

3. Consider the RFCTLARR exemption if you are affected. If you anticipate or have received compensation under the RFCTLARR law, consult a tax professional to ensure the payment is treated according to the new exemption once the Finance Bill is enacted and the relevant clauses notified.

4. Take advantage of the foreign-asset disclosure window if applicable. Small taxpayers with overlooked overseas accounts or income should consider disclosure under the proposed six-month scheme rather than risk later punitive action; watch for the detailed notification and thresholds from CBDT.

5. Keep records to reduce disputes. The Budget signals a shift to trust-based administration, but that does not remove the need for accurate record-keeping. Maintain clear documentation for investments, remittances and declarations in case of future queries.

What the Budget did not do

Raise the overall basic exemption or change slab thresholds: The Budget did not raise the general exemption limit or alter the slab structure under either tax regime — a central disappointment to those expecting a visible tax-rate reprieve for middle-income earners.

Overturn the two-regime framework: The Budget continues to offer taxpayers a choice between the old and the new tax regimes; there is no announcement of a sunset clause for either regime in the Budget materials. (Separately, tax administration remarks in the days following the Budget indicated a strong take-up of the new regime among taxpayers, but no immediate phase-out of the old regime was proposed in the Budget text.)

Why the government chose this route: policy context

The government has framed the 2026 tax measures as part of a broader shift from compliance enforcement to facilitation and certainty. The Finance Minister’s speech and the accompanying tax-reform note emphasise “trust-based tax administration,” reduced litigation, and measures to make the tax system less adversarial. Those objectives explain the emphasis on procedural reforms (simplified TDS/TCS rules, consolidated declarations, extended timelines for corrections) and targeted exemptions, rather than across-the-board rate cuts. The move to a new consolidated Income-tax Act reflects a longer-term overhaul of tax law rather than a one-year fiscal tweak.

Caveats and what to watch next

- Finance Bill and notifications: Budget proposals become law only after the Finance Bill is introduced, debated and passed by Parliament and relevant rules and notifications are issued by the CBDT. Taxpayers should watch for the Finance Bill provisions and subsequent CBDT clarifications, which will set precise thresholds, effective dates, implementation mechanics, and any conditionalities.

- Operational guidance for simplified procedures: Measures such as single-window filing via depositories, the mechanics of the one-time foreign asset disclosure scheme, and TDS/TCS alterations require implementing rules. Taxpayers should wait for those procedural instructions before filing declarations or relying on administrative simplifications.

- Sectoral and corporate measures: The Budget contains a broad range of corporate and sectoral tax changes (MAT rationalisation, buy-back capital-gains alignment, IFSC incentives, etc.) that do not directly affect most individuals but could have second-order effects on markets, investment income and employer behaviour. Analysts and taxpayers with exposure to corporate or capital markets should evaluate these separately.

Bottom line

Budget 2026 is reformist in structure but conservative on headline personal tax rates. The central structural change is the coming into force of the Income-tax Act, 2025 from April 2026, accompanied by administrative measures aimed at simplification, dispute reduction and targeted reliefs (for example, exemption of RFCTLARR compensation, TCS reductions for specified remittances, and procedural reforms for depositories and TDS/ TCS). But the familiar income-tax slabs and surcharge rules that individual taxpayers use to compute their liability remain unchanged in this Budget. Taxpayers should therefore prioritise understanding the procedural changes, watch for Finance Bill and CBDT notifications, and where relevant take advantage of the specific reliefs and disclosure windows the Budget introduces.

Also Read: Gold Price Today Skyrockets – Why Gold Rates in India Jumped Sharply on January 21, 2026

Add News Estate as preferred source on google – click here

Last Updated on: Thursday, February 5, 2026 11:13 am by Monisha Angara | Published by: Monisha Angara on Thursday, February 5, 2026 11:13 am | News Categories: India